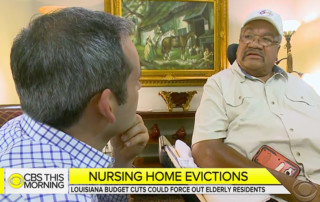

Mentally Disabled Pennsylvanians Can Proceed With Class Action Over ‘Sad Reality’ of DHS Care

By P.J. D'Annunzio A federal class action has been allowed to proceed against the state Department of Human Services, brought by a group of mentally disabled Pennsylvania youths claiming they were left too long in treatment facilities and not given access to proper treatment. U.S. District Judge John E. Jones III of the Middle District of Pennsylvania denied